Who is XM Groupe Broker:

XM broker is a regulated online brokers. XM Group offers clients multi-asset trading on various trading platforms, including the popular MetaTrader 4 and MetaTrader 5 platforms.

The company is regulated by several financial authorities, including the Australian Securities and Investments Commission (ASIC) and the Financial Conduct Authority (FCA) in the UK.

XM pros & cons:

XM broker pros:

1-Wide variety of assets it offers 1,230 CFDs, including 57 forex pairs,Cryptocurrencies, Individual Stocks, Commodities, Precious Metals, Energies and Equity Indices at XM.

2-Autochartist and Trading Central complement in-house research offering for all traders.

3-Live chat and other accessible support in over 25 languages.

4-No commissions :no commission for deposit and withdrawal of money. XM Broker incurs all commission costs of payment systems

5-Easy and fast account opening

6-MetaTrader and XM Mobile App platforms available

7-A comprehensive selection of educational for beginers including webinars, articles, and Tradepedia courses.

XM Broker cons:

1-Standard account spreads are expensive compared to industry leaders.

2-ETF trading not supported.

3-Funding with PayPal unavailable.

XM BROKER REGULATION AND SAFETY :

XM broker is regulated by several financial authorities, including the Australian Securities and Investments Commission (ASIC) and the Financial Conduct Authority (FCA) in the UK.

XM Group is also regulated by the International Financial Services Commission (IFSC) in Belize and the Cyprus Securities and Exchange Commission (CySEC).

Type of trading account offred by XM broker:

XM account opening is easy and simple. You may be able to start using your account already on the same day,xm broker pffer 4 trading account types :

MICRO: 1 micro lot is 1,000 units of the base currency

STANDARD: 1 standard lot is 100,000 units of the base currency

Ultra Low Micro: 1 micro lot is 1,000 units of the base currency

Ultra Low Standard: 1 standard lot is 100,000 units of the base currency

By opening a forex account, you will be automatically emailed your login details, which will give you access to the XM Members Area.

The XM Members Area is where you will manage the functions of your account, including depositing or withdrawing funds, viewing and claiming unique promotions, checking your loyalty status, checking your open positions, changing leverage, accessing support and accessing the trading tools offered by XM.

XM BROKER payment options for deposits/withdrawals:

XM broker offer a wide range of payment options for deposits/withdrawals: by multiple credit cards, multiple electronic payment methods like : Neteller, Skrill, UnionPay, Web money,they also have bank wire transfer, local bank transfer, and other payment methods.

As soon as you open an XM trading account, you can log in to your Members Area, select a payment method of your preference on the Deposits/Withdrawal pages, and follow the instructions given.

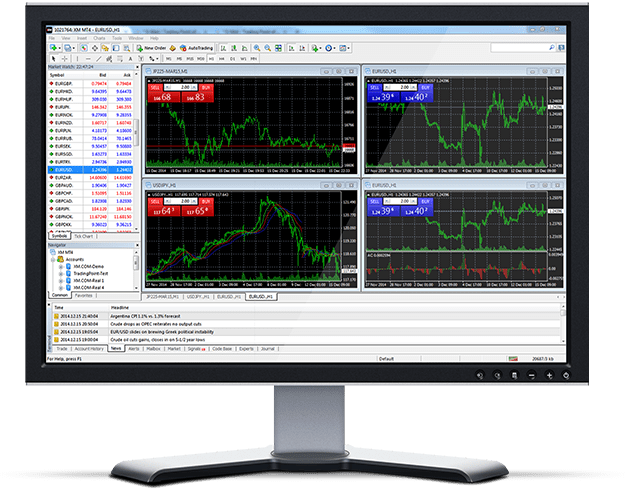

XM BROKER Trading Platforms:

XM offer MetaTrader 4 and MetaTrader 5 as a trading platforms. You can Trade on MT4/mt5 with No Requotes, No Rejections with flexible leverage ranging from 1:1 — to 1000:1.

XM BROKER MT4/MT5 Features:

Over 1000 instruments including Forex, Cryptocurrencies, CFDs, and Futures

- 1 Single Login Access to 8 Platforms

- Spreads as low as 0.6 pips

- Full EA (Expert Advisor) Functionality

- 1 Click Trading

- Technical Analysis Tools with 50 indicators and charting tools

- 3 Chart Types

- Micro Lot Accounts (Optional)

- Hedging allowed

- VPS Functionality

XM RESEARCH AND TOOLS FOR TRADERS:

XM broker offer many trading tools at your hand, online investors have access to a wide choice of professional technical analysis tools to help making the best trading decision:

XM Research:

here you will find Daily Market Comment and Technical Analysis for many asset provise for free by XM broker expert.

XM broker Trade Ideas:

XM broker give you trading ideas under the ‘Trade Ideas’ tab, where you can find various FOREX pair and their recent performances. Its like a signal lab, also for free by XM.

Technical Summaries:

XM Group offers technical summaries on various financial instruments, including forex, commodities, indices, and stocks. These summaries provide an overview of the market conditions and technical analysis for a particular instrument.

Economic Calendar:

XM broker provides an economic calendar on its website that lists important economic events, data releases, and announcements from around the world.

XM Customer service :

XM broker offers customer support through various channels, including live chat, email, and telephone. The company has a dedicated customer support team that is available to assist clients with any questions or issues they may have.

Many clients have praised the XM company for its quick response times and helpful support SERVICE.

XM and Security of funds:

XM Group takes the security of client funds seriously and has implemented measures to ensure the safety of funds. Some of the measures that XM Group has in place to ensure the security of client funds include:

Segregation of client funds:

XM broker keeps client funds in separate accounts from the company’s operating funds, which helps to ensure that client funds are protected in the event that the company experiences financial difficulties.

Secure servers:

XM Group uses secure servers to protect client information and ensure the safety of online transactions. Compliance with financial regulations: As a regulated broker, XM Group is required to adhere to strict financial regulations and guidelines. This includes maintaining sufficient capital and insurance to protect client funds.

Risk management policies:

XM broker has implemented risk management policies to ensure that the company is able to manage its financial risks effectively. It is always important to carefully consider the security of client funds when choosing a broker.

XM market conditions:

EXECUTION POLICY:

XM has pioneered at introducing a no re-quotes and no rejection of orders policy since 2010. We offer 100% execution of orders with 99.35% of all our orders executed in less than 1 second.

XM SPREADS:

XM offers tight spreads to all clients, irrespective of their account types and trade sizes. the fact that tight spreads only make sense for FOREX traders if they can trade with them. This is the reason why XM broker attribute great importance to our execution quality.

MARGIN AND LEVERAGE:

At XM clients have the flexibility to trade by using the same margin requirements and leverage from 1:1 to 1000:1.

XM’s margin requirements and leverage are based on the total equity in your account(s) as described below:

| Leverage | Total Equity |

|---|---|

| 1:1 to 1:1000 | $5 – $20,000 |

| 1:1 to 1:200 | $20,001 – $100,000 |

| 1:1 to 1:100 | $100,001 + |

Conclusion:

XM is a regulated online broker that is overseen by several financial authorities around the world, including the highly reputable Australian Securities and Investments Commission (ASIC). One of the benefits of using XM is the low fees for stock CFDs and withdrawals. The account opening process is straightforward, and the broker offers a range of high-quality educational resources.

However, it’s worth noting that XM’s product offerings are limited to forex and CFDs. The fees for forex and stock index CFDs are average, and investors from outside the EU are not covered by any investor protection.

We recommend XM for traders interested in forex and CFD trading who prefer the MetaTrader platform. You can try out the broker using the demo account to see if it’s a good fit for your trading needs.

https://clicks.pipaffiliates.com/c?c=701252&l=en&p=0XM Contact Info:

XM company Telephone: +357 25029933.

Company Address:12 Richard & Verengaria Street, Araouzos Castle Court, 3rd Floor, 3042 Limassol, Cyprus

Some XM BROKER FAQs:

Q:How can I view my trading history?

A:Open the terminal window by pressing Ctrl+T on your keyboard, and select the Account History tab. Right click to enable the context menu, which will allow you to save your trading history as an .html file so that you can later view it when you log out of the trading platform.

Q:What is the minimum and maximum amount that I can deposit/withdraw?

A:The minimum deposit/withdrawal amount is 5 USD (or equivalent denomination) for multiple payment methods supported in all countries. However, the amount varies according to the payment method you choose and your trading account verification status. You can read more details about the deposit and withdrawal process in the Members Area.

Q: How long until my deposit reflects on my account balance?

A: All deposits are instant, except for the bank wire transfer.