HOW TO CHOOSE THE BEST FOREX BROKER

Forex is foreign currency and exchange, simply the operation of converting one currency to another one, for different reasons like tourism, trading, commerce, etc…

The daily trading volume for forex reached $5.6 trillion a day, which makes it great for investors to make a profit, also it is a high-risk environment for people without the right education.

So to minimize the risk a trader must choose a forex broker with a solid reputation, that can help to maximize profit

There are different factors to consider when you want to choose the best forex broker, for example, you should look for forex brokers with low spreads, markets to trade like commodities, stock CFDs, ETF CFDs, and cryptocurrencies, and many other features that we will cover in this article.

What is a Forex Broker?

A forex broker is a financial company that gives traders access to the forex market using an online system for buying and selling orders, especially buying and selling currencies pairs and other CFD products (contract for difference), by doing that a forex broker

make money from the spread(the difference between the buy and sell price).

What are the different types of forex brokers :

1-Market Makers :

Market makers are brokers or companies that provide liquidity to the markets by providing bids and asks, sometimes market makers can manipulate currency prices to run their customers’ stops, so a trader must be aware of that.

2-STP (Straight-Through-Processing) :

A forex broker is Straight-through processing (STP) when it uses an automated process for trades, simply buying and selling orders relies entirely on electronic transfers and does not require any manual effort, which means that there is no manual intervention from the broker when trades are executed

3-DMA (Direct Market Access):

Direct market access refers to the ability to execute trades directly through the electronic systems and order books of financial market exchanges.

4-ECN (Electronic Communication Network) :

An electronic communication network (ECN) is a computerized system that

matches buy and sell positions for currency pairs or any asset in the market.

HOW TO CHOOSE THE BEST FOREX BROKER?

for new traders, picking a good forex broker is difficult. you will find below all factors to consider when choosing the best forex broker for you.

1-regulation:

A regulation firm is an organization that gives rules and regulations that govern financial institutions

Like forex brokers, banks, hedge fund companies, etc. those organizations are very important because they protect consumers, investors, and the financial system from fraudulent activities.

Every country has a regulatory body that establishes the guidelines that must be followed when participating in the forex market.

in the European Union :

Below is a list of financial regulations in Europe, the united state, and Australia :

Malta Financial Services Authority (MFSA) in Malta.

• Comissão do Mercado de Valores Mobiliários (CMVM) in Portugal,

• Financial Market Authority (FMA) in Austria,

• Comisión Nacional de Mercado de Valores (CNMV) in Spain,

• Bundesanstalt für Finanzdienstleistungsaufsicht (BaFin) in Germany,

• Swiss Financial Market Supervisory Authority (FINMA) in Switzerland,

• Finanstilsynet (FSA) in Denmark,

• Autorité des Marchés Financiers (AMF) in France,

In the UK :

the Financial Conduct Authority (FCA)

The Prudential Regulation Authority (PRA),

In the USA :

The National Futures Association (NFA)

the Commodity Futures Trading Commission (CFTC).

In Australia :

The Australian Securities & Investments Commission (ASIC)

How do I know if my forex broker is regulated :

Most brokers will include regulatory information, risk disclaimers, and other information on their websites, also when you will open a trading account with a forex broker they will show regulatory information in legal documents.

To avoid risk as a trader you can always visit the regulator’s website to see if the broker is listed. and it’s always best to pick a forex broker that is regulated in several countries.

2-Spreads :

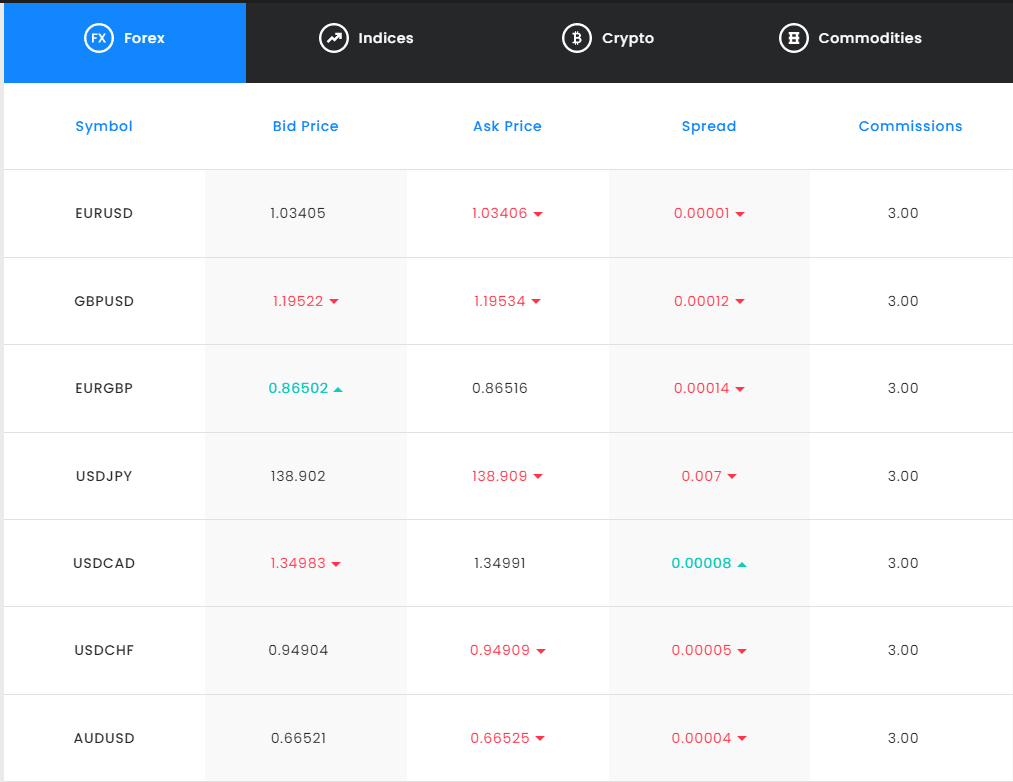

The spread is the difference between the ask (sell) and bid (buy) prices, The pro traders always choose forex brokers with low spreads, especially traders with high volume positions.

3-Trading platforms :

There are several platforms to choose from when it comes to trading, Depending on your needs, you might choose a platform with automatic trading or one that is easier to use.

Many forex brokers have their platform and most of the theme offer MetaTrader as the main platform.

4-Customer support:

customer support is a vital part of the trading experience. Whether you’re a beguiner trader or a professional one, you need reliable customer support when things go wrong.

So as a trader you must check if a forex broker can act quickly to resolve problems and if they offer support in your language.

5-fast deposits and withdrawals:

Always pick a forex broker that offers numerous deposit methods for an easier trading experience. like credit and debit card

bank transfer or certain e-wallet payment methods as well.

Conclusion :

choosing the best forex broker, for you to work with depends on who you are as a trader and what your goals are for the future. Anyway, there is a large number of forex brokers that will meet your needs so take your time and do your homework!