I will share with you in this article how i made 8500 dollar in one single trade by trading only the NASDAQ index (US100) in the New York session.

Before explaining how I made $8,500 in one single trade, you should know that I am an E-mini trader. That means I only trade the four famous United States indices, which are: NQ (US100), ES (S&P 500), Russell 2000, and the famous US30 (Dow Jones). So, the strategy and the method of how I made $8,500 in one single trade will be especially an E-mini trading strategy. Let’s go, my dear traders!”

What you need to know about E-mini indices?

All you need to know is that trading E-mini indices is about mathematics and pure probabilities, backed by human psychology, which is the most challenging part of trading. But if it’s so simple, why do many traders still lose money day after day? The answer is also straightforward because they study patterns and strategies that they find online and in PDFs. Many of these strategies are either designed for beginners to learn or have a low winning ratio. So, be careful when you choose to learn strategies.”

When most beginners start studying new patterns and ideas, they don’t put them to the test with a demo account or paper trading in general to know exactly how effective they are. For example, when I started trading, it was too difficult for me. I lost a lot of money and burned as many accounts as you can imagine! I learned a lot of things, of course. I spent so much time and effort trying to understand when I’m wrong and trying to find solutions to be better. I also wasted hundreds of hours on guru nonsense that does not work!

But that was the price you will pay also to be a good trader. It’s not an easy way to make money. As they say, trading is the hardest way to make an easy buck! So, learn, focus, and stay motivated. That’s all you need!”

How to find a trading strategy that suit you?

Every human being is unique! We are all different, and each one of us has something special that others don’t have.

It’s also true when it comes to trading, we all know that anyone can start trading and be profitable and consistent, so how do you choose a trading strategy that suits your personality and lifestyle?

The first thing you have to do is to choose a strategy with a 65-70% winning chance. That means for every 10 trades, you will have 6 or 7 winning trades, so you are winning more than you are losing.

Then you need to learn how to manage risk. What I mean is how to choose entry and exit points, how to place your stop-loss and take profit. Also, you need to pay attention to the reward ratio of your trading strategy.

Dont forget trading psychology,you have to controle and understan your own emotions, such as fear, greed, and discipline.To be a successful trader you need to be calm with a strong mindset,stick to your trading plan, and effectively manage your emotions to make informed decisions.

I will show you after how i made 8500 dollar in one single trade using all above steps,so are your ready!

How Much Money you need to start trading?

All beginner traders ask this question: how much do I need to start trading? Well, it depends on what you are willing to trade—forex, stocks, futures contracts, or even commodities. It depends on how much you are ready to invest and put at risk.

In theory, it’s hard to specify an exact amount to start trading. Logically, if you have a larger capital, you have the possibility to make bigger profits and trade larger positions.

For me, I recommend starting with $5,000 if you want to trade forex or CFDs (contracts for difference). When it comes to how i made 8500 dollar in one single trade, my account size was about $102,500. I entered a 20 standard lot position in US100 (with $200 per pip), and I made 42.5 pips, resulting in an $8,500 profit.

If you don’t have money to start trading, you can try to get a funded account with proprietary trading firms like FTMO. They offer various capital amounts ranging from $25,000 to $200,000.

My Routine and how i choose my trades

Alright, so my day usually kicks off around 5:00 AM. The first thing I do is grab my coffee and dive into the overnight news. Gotta see what’s been going on globally that might shake things up. Then, I check all the pre-market indicators – futures, what’s been happening in international markets, any economic reports that dropped.

Next up, I take a peek at my open trades from yesterday. Adjust any stop-loss or take-profit levels if needed and sketch out a plan for the day. You know, jot down potential entry and exit points for the stocks I’m eyeing.

By the time the market opens at 9:30 AM, I’m glued to my screen. It’s all about staying sharp, watching for any sudden moves or volatility. I stick to my plan but stay flexible, ready to pounce on any new opportunities that pop up based on what’s happening in the morning.

Once we’re into the thick of the morning session, it’s go-time. I’m actively trading, adjusting positions as needed, and keeping a close eye on price action, volume – basically anything that might signal a good move.

Come midday, things tend to slow down a bit. I use this time to take a breather, review how my morning went, and tweak my strategy if necessary. And of course, stay tuned in to any midday news that could shake things up for the afternoon.

When the afternoon session rolls around, it’s back to business. Market activity usually picks up again, so I’m back in the zone, executing trades and staying vigilant for any last-minute opportunities or risks.

Once the closing bell rings at 4:00 PM, it’s time to take stock of the day. I review my performance, see how my trades played out, and jot down any lessons learned. If there are any open positions, I decide whether to close them out or hold overnight.

After that, it’s post-market analysis time. I dive deep into the day’s trades, looking for patterns, strengths, weaknesses – anything that can help me improve. Then, I start prepping for tomorrow, researching potential trades, tweaking my watchlists, and making sure I’m in the right headspace for another day of trading.

Finally, around 6:00 to 9:00 PM, I wind down. Reflect on my mindset, maybe do some light reading on trading psychology, and most importantly, make sure I get a good night’s sleep. Consistency, discipline, and always staying hungry to learn – that’s what keeps me on top of my game.”

How i made 8500 dollar in one single trade?

When it comes to how I made $8500 in one single trade with a simple strategy, I can say that it’s really a well-known strategy called Moving Average Trend Trading.

Some traders use moving averages as potential entry and exit points for day trading. all E-mini indices will start an upside or downside trend after the morning session (around 11 a.m. New York time) and you will see their moving averages in 1-minute and 3-minute charts as a type of moving support or resistance line.

As an E-mini trader i try to benefit from this behavior and ride the trend along the moving average (on top of the moving average for going long or below the moving average for short selling).

In the Moving Average Trend Trading., I use two moving average 9 and 20 Exponential moving averages (EMA) .

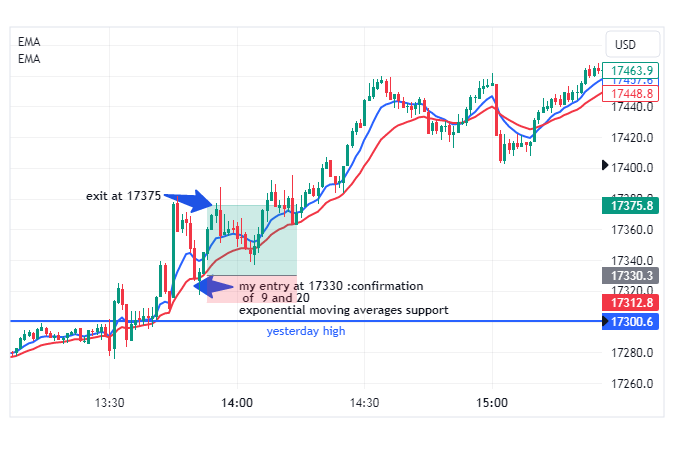

the chart below presente the time when i placed the trade ,you wil understand how i made 8500 dollar in one single trade,its very simple.

As you can see, I noticed that the US100 index was in a consolidation mode near the 17320-17330 area and that the consolidation period was happening on top of the 9 EMA and 20 EMA. As soon as I saw that the 9 EMA and 20 EMA were holding as support, I jumped into the trade. My stop loss was set at 10 pips, and my take profit was 45 pips(the position size is 20 standar lot wich mean 200 dollar a pip), which means a 1:4.5 risk ratio. So, do you see how I made $8500 in one single trade? The price made another high after that, as you can see in the chart.

in general moving average Trends can happen in any intraday time frame. I watchprices on both 1-minute and3-minute charts and make my trades based only.

Keep in mind this if you want to use the Moving Average Trend Trading strategy:

- First off, when I’m keeping an eye on an E-mini indice and see a trend forming around a moving average, typically the 9 EMA, that’s my cue for trend trading. I dive into the previous day’s trading data, usually on a 1-minute or 3-minute chart, to gauge how the indice is reacting to these moving averages.

- Once I’ve got a handle on which moving average suits the E-mini indice behavior best, I pull the trigger. I buy into the E-mini indice once I’ve got confirmation that the moving averages are acting as support. I aim to get in as close as possible to the moving average line to keep my stop tight. Typically, my stop sits around 5 to 10 pips below the moving average line, or if it’s a candlestick, I look for a close below the moving average for long positions. For shorts, a close above the moving average would be my signal to bail.

- Then, it’s all about riding that trend until it breaks the moving average. I keep a close eye on the trend with my own eyes.

Now, if the stock starts soaring away from the moving average, racking up some hefty unrealized profits, I might consider cashing in. Usually, I’ll take profits at around half of my position. I don’t always wait for the moving average to break before I exit.

I think now you know how i made 8500 dollar in one single trade, so are you ready to use the same strategy to make also profit.

Conclusion about how i made 8500 dollar in one single trade

In conclusion, mastering a trading strategy to make profit requires dedication, discipline, and big effort to adapt and learn from mistakes. By following a structured approach and leveraging effective risk management techniques, traders can navigate the complexities of the market and achieve consistent profitability. So, armed with the knowledge of how I made $8,500 in one single trade, are you ready to work on your trading journey and make consistant profit?