Today, I want to take you on a journey through my trading day on 06/11/2024 with my 50K FTMO Challenge.

Before starting, I have to mention that 06/11/2024 is the first day of the challenge.

Below are the results of the 2 trades that I took at the opening of the US100 index:

Overview of Market Conditions on 06/11/2024

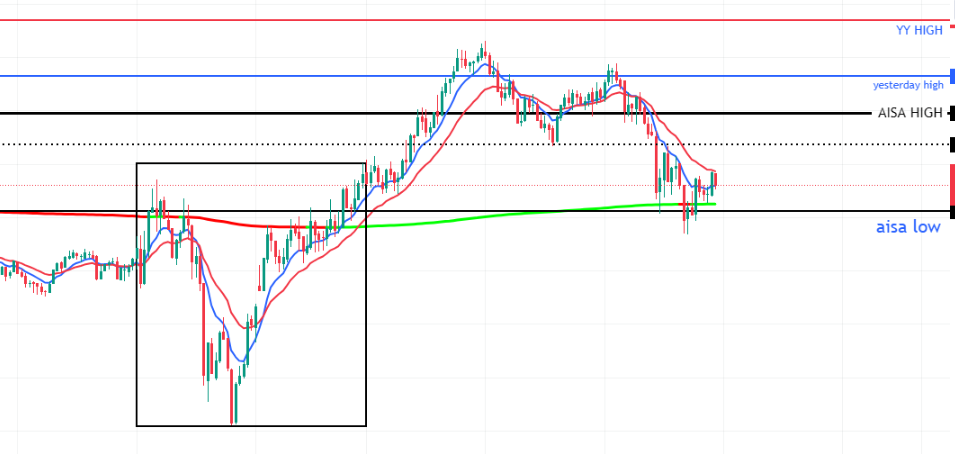

The market conditions on 06/11/2024 were characterized by significant volatility and a mix of both optimism and caution both in AISA and london session, as you can see below the us100 was in a down trend in the 3 min chart before the new york stock exchenge open, and the price was below the vwap.

At the open, the US100 price tested the VWAP with a double top pattern. I took the first trade at 19030.65 with a 5-pip stop loss and closed the position with a 10-pip profit. The price moved 50 pips down, but I chose to close my trade earlier, which was a mistake on my part. Another mistake was not having a defined profit target, so next time I will ensure to set both a stop loss and a profit target.

My second trade was at 18996.65. I entered this trade because I saw that the price had pulled back to the 9 EMA on the 1-minute chart. I closed it with a 4.6-pip profit. I should have let the position run for more than 30 pips, similar to the mistakes in the first trade.

After that, the price gave a nice reversal from 18966 back to VWAP. I couldn’t catch the movement because it was too risky for me, and I didn’t want to expose myself to risk and give back my profit to the market.

A good entry for a reversal trade could have been at 19005 when the price breached both the 9 EMA and 20 EMA on the 1-minute chart, with a stop loss at 18993 (12 pips) and a profit target at VWAP 19036 (30 pips), which is a 1:3 risk-reward ratio.

Another missed trade was a buy at aisa low of 19042 with stop losse at 19032 and the profit trget would be at aisa high or yesterday high as you can see in the chart.

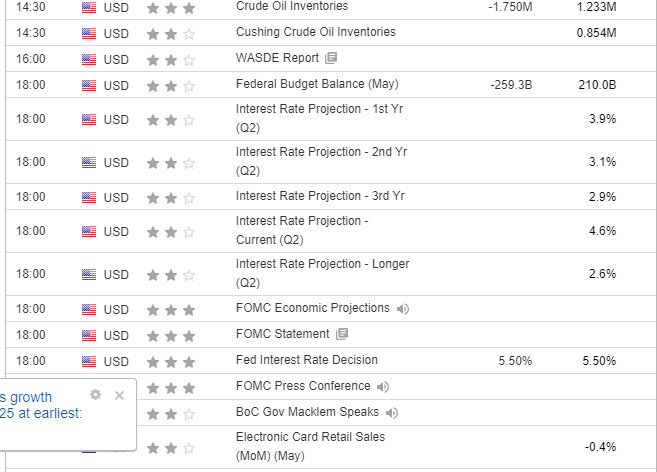

After that, the price went above VWAP to test yesterday’s high, as you can see in the chart. The price reversed from yesterday’s high; it was clear, but again, I didn’t take the trade because I preferred to keep my small $150 profit rather than expose myself to the market. Don’t forget, this is my first day of the challenge, so I need to take it slowly. My goal is to manage risk. It’s okay for me to take only a $150 profit for today. My goal for tomorrow is $800. I know I can achieve that. Tomorrow will be a busy day with a lot of data and news, especially the United States interest rates, as you can see below.

Economic calendar for 07/11/2024

What was good to repeat and what was bad to avoid:

I think what was good is that I was patient and got really good entries at the opening. What was bad is that I didn’t have a predefined profit target, so I went into panic mode and took small profits as fast as I could. Next time, I will set both a stop loss and a take profit, and I will let my profits run to achieve good risk/reward ratios.

That’s all for today. My goal for tomorrow is to make $800 and avoid my mistakes, learning from them if i can say.

think you and see you tomorow.

Some images for us100 in 06/11/2024 in different time frame:

us100 in 06/11/2024 in DAILY time frame:

us100 in 06/11/2024 in 4h time frame:

us100 in 06/11/2024 in 3 minute time frame:

us100 in 06/11/2024 in 1minute time frame: