How a Trading Journal Can boost Your trading results

Every trader, from novice to seasoned professional, faces the challenge of navigating the complexities of the market with the aim of maximizing profits and minimizing losses.And as most traders know ,this is not an easy task to do!,so thats why every forex trader is looking for tools that can help boosting trading results,one of those tools is a trading journal!

So how to create a good trading journal and how to use it to boost your trading results?

Don’t worry, it may seem difficult to create a trading journal if this is your first time doing so. In this article, I will help you by providing step-by-step instructions to create a trading journal and utilize it to boost your trading results!

What is a Trading Journal ?

A trading journal simply is a history of your trades, your emotion,and how your trade, its the map of your trading systeme,a trading journal as i said is powerful tool that can boost Your trading results if you know how to uze it effectively!

You can start a trading journal by keeping detailed records of trades. You can do this by noting your entry and exit points of positions, lot size, time of the trade, and how long you held a trade. Additionally, you can document your emotions when you took the trade, such as feelings of anger, fear, or greed. This allows you to pinpoint what works for you and what doesn’t, helping you make more informed decisions in the future. Furthermore, this data can be used to identify any psychological issues that may be impacting your results as a trader, and finding solutions to boost your trading results.

If you do this, you will understand yourself better, you will control your emotions when trading, you will know your mistakes and how to avoid them in the future. This will not only help you in boosting your trading results but also in life in general.

How to start a trading journal?

Before starting a trading journal, my dear trader, you must know that a trading journal isn’t just about recording wins and losses; it’s about understanding yourself and your trading system. It helps you detect common patterns, both in the market and in your own behavior as a human. It’s about gaining insights into what works, what doesn’t, and how to improve. By analyzing your trades every day, you can identify your strengths and weaknesses, and optimize your trading strategies to boost your trading results.

So here a 8 steps to create a trading journal and boost Your trading results :

Choose Your Format:

Decide whether you want to keep your journal in a physical notebook or use digital tools such as spreadsheets, trading journal software, or mobile apps.

Define Data Points:

Determine the essential information you want to record for each trade, including entry and exit points, trade duration, position size, instrument traded, market conditions, and any specific trading strategy employed.

Create a Template:

Design a template or format for your journal entries that includes space for all the data points you identified in step 2. This template will streamline the process of recording trades consistently.

Record Your Trades:

Start documenting your trades systematically using the template you created. Make sure to enter all relevant information for each trade promptly after it occurs to ensure accuracy.

Include Emotional Insights:

In addition to trade details, consider including a section in your journal to note your emotions before, during, and after each trade. This can provide valuable insights into how emotions influence your trading decisions.

Regularly Review and Analyze:

Set aside time on a regular basis (daily, weekly, or monthly) to review and analyze your journal entries. Look for patterns, identify strengths and weaknesses, and assess the effectiveness of your trading strategies.

Learn from Mistakes:

Use your journal as a learning tool by identifying common mistakes or recurring issues in your trading. Develop strategies to address these challenges and avoid repeating them in the future.

Adjust and Improve:

Based on your journal analysis, make adjustments to your trading approach, risk management strategies, and emotional control techniques as needed. Continuously strive to improve your trading performance based on insights gained from your journal.

By following these steps, you can establish a good trading journal that will help you track your progress, boost Your trading results,gain valuable insights, and ultimately improve your trading results over time.

How to use trading journal to achieve consistent results?

To achieve consistent results by using trading journal you have to examine your trading journals at least two or three times a week.

Because Reviewing your trading journal regularly will help you to identify patterns in your trading, areas where you are struggling, and opportunities for improvement.

Here are some specific things to look for when reviewing your trading journal:

- Win rate percentage : What percentage of your trades are profitable?

- Average profit per trade: How much are you making on your winning trades?

- Average loss per trade: How much are you losing on your losing trades?

- Risk-reward ratio: Are you risking more than you are making on your trades?

- Emotional state: Were you feeling emotional during any of your trades? Did this affect your decision-making?

- Trading discipline: Did you stick to your trading plan?

Once you have identified areas where you need to improve, you can start to make changes to your trading strategy and approach. For example, if you have a low win rate, you may need to tighten your entry and exit criteria. If you are risking too much on your trades, you may need to reduce your position size.

By reviewing your trading journal regularly, you can make incremental improvements to your trading over time. This will lead to better performance and more consistent profits.

In addition to weekly reviews, it is also a good idea to review your trading journal at the end of each month and quarter. This will give you a longer-term perspective on your trading and help you to track your progress.

Using trading journal to master Risk Management

Through regular review and analysis of your trading journal entries, as we said before you can identify patterns in your trading behavior and risk-taking tendencies. This self-awareness allows you to recognize when you may be deviating from your risk management strategy or succumbing to emotional impulses. Armed with this knowledge, you can implement corrective measures to mitigate risk, such as adjusting position sizes, setting stop-loss orders, or diversifying your portfolio.

Moreover, a trading journal facilitates the evaluation of the effectiveness of different risk management techniques over time. By comparing the outcomes of trades executed with varying levels of risk management measures in place, you can refine their approach and adopt strategies that align more closely with your risk tolerance and financial goals.

Exemple of my trading journal

As an ftmo trader, maintaining a meticulous trading journal is the cornerstone of my success. Each entry serves as a roadmap, guiding my decisions and refining my strategies.

This how my ftmo trading journal looks like:

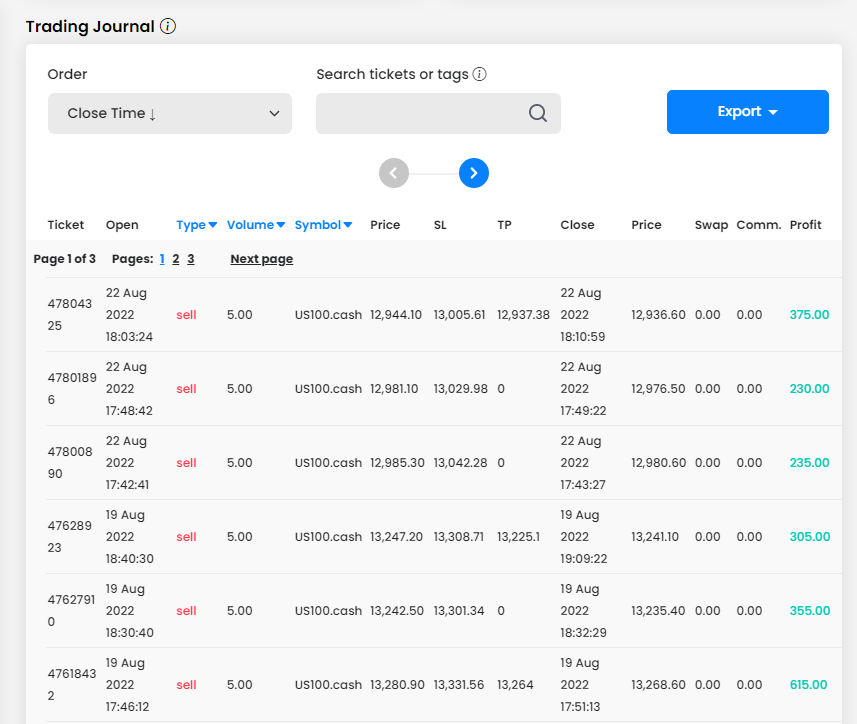

My ftmo trading Journal trades :

These trades demonstrate my adherence to my trading strategy, incorporating both technical and fundamental analysis while managing risk effectively. Each trade provides valuable insights for future decision-making, contributing to my ongoing growth and success as a trader.

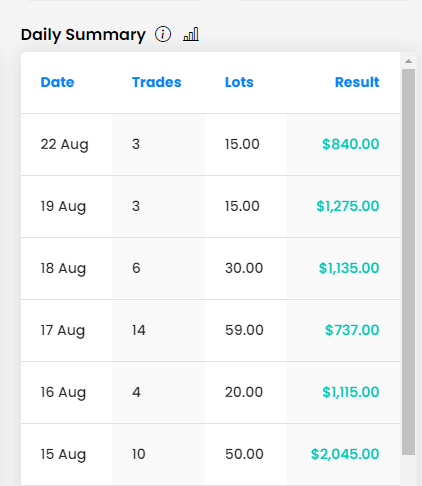

My ftmo Daily Summary:

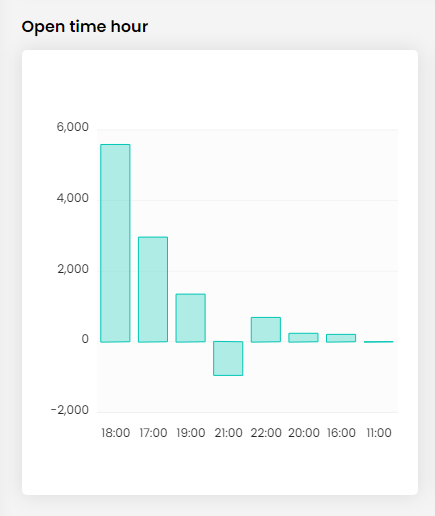

Open time hours:

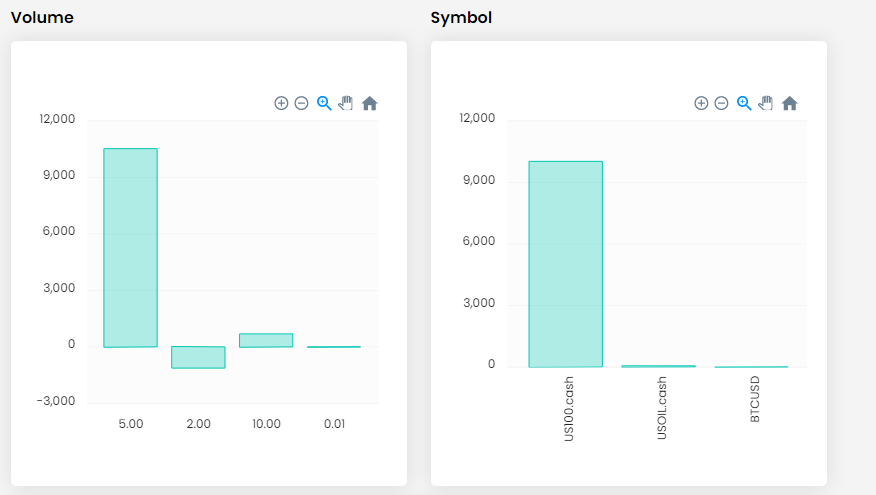

volume and symbol

monthly performance

Conclusion

Maintaining a trading journal offers numerous benefits for traders. It helps you keep track of your trades, analyze your performance, and identify patterns in your behavior and the market. Whether you’re a beginner or an experienced trader, starting or continuing journaling can greatly enhance your trading journey.

It provides a structured way to reflect on your decisions and emotions, allowing you to make more informed choices in the future. By regularly reviewing your journal entries, you can learn from your mistakes, capitalize on your strengths, and refine your strategies over time. Ultimately, self-reflection is key to success in trading, and a trading journal serves as a powerful tool to support this process. So, embrace the practice of journaling and let it guide you towards achieving your trading goals.