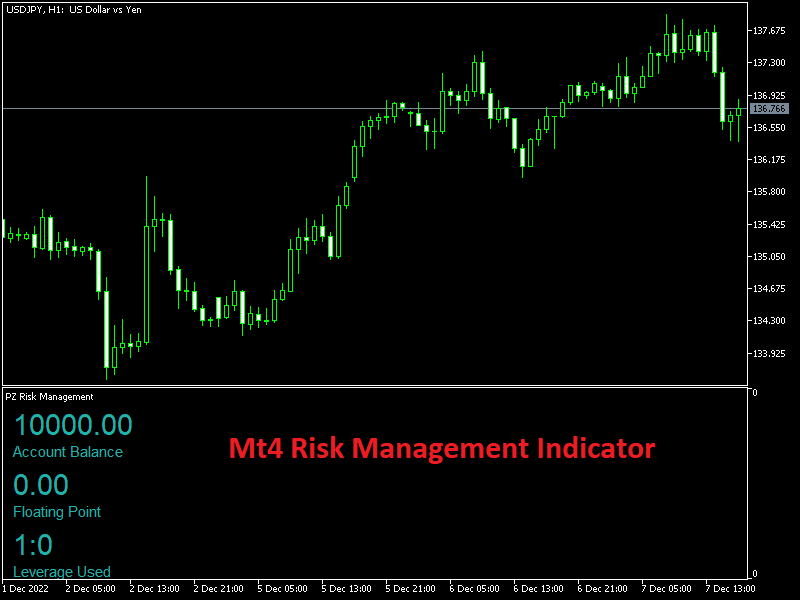

Mt4 Risk Management Indicator

mt4 risk management indicator and why it is necessary :

The mt4 risk management indicator monitors your trading account’s essential risk to keep it safe from excessive losses, It tracks all current trades, absolute exposure, account floating point, and leverage. And it’s really helpful for beginners traders.

This mt4 risk management indicator is amazingly easy to understand, is clean and simple and It calculates exposure by pairs and currencies, also it helps to control your used leverage at all times.

Before using this indicator you must know the details :

* Load the indicator just once in an empty chart.

* The indicator calculates net exposure for each symbol.

* Symbols with more than 6 characters in their names are ignored in the currency exposure table.

How to install mt4 risk management indicator :

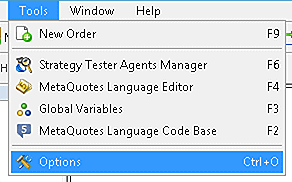

To install a risk management indicator in your Metatrader Platform, follow these steps :

1-Open Metatrader

2- Click on Tools -> Options -> Community Tab.

2-2) Click on “If you have an account, please log in”.

2-3) Enter your mql5.com username and pasword.

3-On Metatrader 4 (MT4), click on View -> Terminal -> Market -> Downloads Tab.

4-4) Type mt4 indicator and Click on “install” or “download”.

Finally, load the mt4 risk management indicator to the chart.

Download the mt4 indicator here.

3-How to use the mt4 risk management indicator properly :

When it comes to trading, risk management is the key to consistency.

By using the mt4 risk management indicator, you can help to manage your risk and keep your trading account safe.

In a general way, the mt4 risk management is a simple indicator that can help you to decrease your odds of having a high exposure,

but when you trade you should always have a plane of your gain potential, as well as your potential loss.

Mt4 risk management indicator in day trading strategy :

We will use a strategy named 200 and 20 EMA crossover trading strategy.

1-in a bullish market:

1-Buying rules :

1-Price must be above the 200 ema line in the 15 min chart

2-20 ema crosse 200 ema and goes up.

3-wait for the price to test the 20 ema then enter a buy position.

For stop loss, we will set 10 pips stop order at the nearest swing low, for take profit ,just set your take profit order

at the previous swing high and use trailing stops with the management indicator to minimize risk.

2-in bearish markets :

Selling rules:

1- Price must be below the 200 ema line in the 15 min chart.

2- 20 ema crosse 200 ema and goes down.

3- wait for the price to test the 20 ema then enter a sell position.

For stop loss we will set a 10 pips stop order at the nearest swing high, for take profit,

set your take profit order at the previous swing low and always use trailing stops with the management indicator to minimize risk.

Conclusion:

When it comes to trading forex, managing your risk is essential to success.

There are a number of different ways to do this, the Mt4 risk management indicator will

help you manage your risk by displaying your risk exposure at all times, and it can help you to make more profitable trades

but you should always have plane for your stop losses and tac profit.