What is a Lot in Forex?

In the world of forex trading, mastering the concept of “lots” is paramount for success. Whether you’re a seasoned trader or just starting out, comprehending what lots are and how they affect your trading decisions is essential. Let’s delve into this fundamental aspect of forex trading and explore its significance.

Understanding lots in forex

Lots serve as a cornerstone concept in forex trading, representing the size of a trade position. A lot is essentially a standardized quantity of a financial instrument that is traded on the market. In forex trading, a standard lot typically consists of 100,000 units of the base currency.

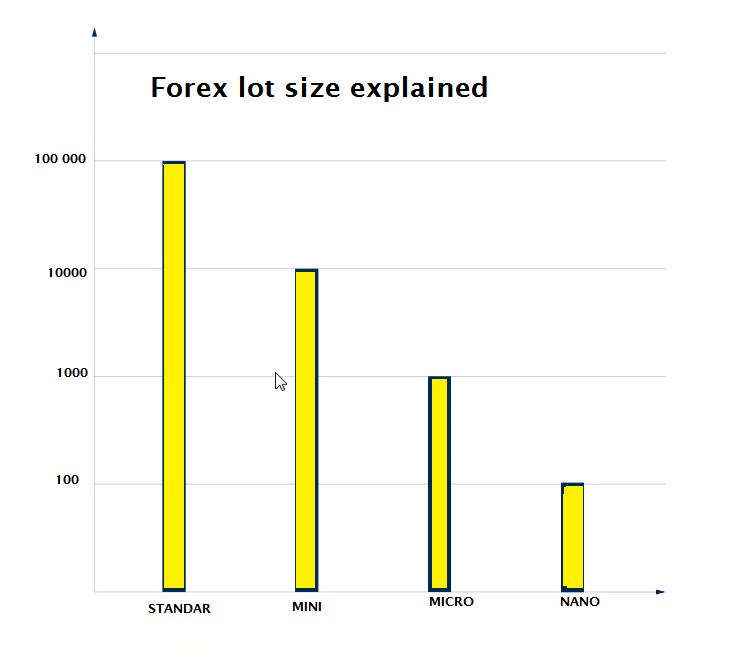

Lots are subdivided into four sizes – standard, mini, micro and nano – to give traders more control over the amount of exposure they have.

The four lot sizes explained

Wondering how much one lot is in forex? Well, it varies depending on whether you’re dealing with a standard, mini, micro, or nano lot. These terms might sound technical, but they’re just standardized units of measurement used in forex trading. They’re handy because they allow traders to account for even the tiniest shifts in currency values.

The following examples all relate to the currency pair GBPUSD, which compares the POUND (the base currency) against the dollar (the quote currency). For context, if you buy GBP/USD, you’re speculating that the POUND is going to strengthen against the dollar. If the quote price is currently $1.4000, that means you can exchange 1 pound for $1.3000. To put it the other way around, you need $1.3000 to buy 1 pound.

Definition of a standard lot in forex:

A standard lot in forex refers to a standardized unit of currency trading that consists of 100,000 units of the base currency. For example, if you’re trading the EUR/USD currency pair and you buy one standard lot, you’re essentially buying 100,000 euros. This standardization helps traders manage large transactions and facilitates uniformity in the forex market.

Definition of mini lot in forex:

A mini lot in forex is a smaller unit of currency trading compared to a standard lot. It consists of 10,000 units of the base currency. For example, if you’re trading the USD/JPY currency pair and you buy one mini lot, you’re essentially buying 10,000 US dollars. Mini lots are commonly used by retail traders with smaller capital because they allow for smaller transaction sizes and reduced risk exposure compared to standard lots.

Definition of micro lot in forex:

A micro lot in forex is a unit of currency trading that is smaller than a mini lot and larger than a nano lot. It consists of 1,000 units of the base currency. For example, if you’re trading the EUR/GBP currency pair and you buy one micro lot, you’re essentially buying 1,000 euros.

Definition of nano lot in forex:

A nano lot in forex is the smallest standardized unit of currency trading, representing 100 units of the base currency. For example, if you’re trading the GBP/USD currency pair and you buy one nano lot, you’re essentially buying 100 British pounds. Nano lots are typically utilized by traders who want to trade very small positions.

The best way to calculate the lot size when trading forex :

Determining the ideal lot size when trading forex is crucial for managing risk and maximizing potential profits, Typically, you won’t have to manually compute the lot size because your trading platform will provide this information. When placing a trade, your platform should clearly display the available options—standard, mini, micro, and nano—and indicate which lot size you’re utilizing. This ensures clarity and ease of use, allowing you to focus on executing your trades effectively.

But when it comes to risk management the most effective method for calculating lot size is to consider your account balance, risk tolerance, and the size of the stop-loss you’re comfortable with. A commonly recommended approach is to risk a small percentage of your account balance per trade, typically between 1% to 2%.

For example, if you have a $10,000 trading account and you’re willing to risk 1% per trade, your maximum risk per trade would be $100. With this figure in mind, you can then calculate the lot size based on the distance between your entry point and your stop-loss level. By adhering to this disciplined approach, you can ensure that each trade aligns with your risk management strategy, ultimately increasing the likelihood of long-term trading success.

Dont forget that In forex trading, the value of a one-pip movement varies depending on the lot size:

- Standard lot: $10

- Mini lot: $1

- Micro lot: $0.10

- Nano lot: $0.01.

Keep in mind that the currency value is contingent on the base currency in the currency pair you’re trading. As demonstrated, smaller lot sizes result in lower costs for a one-pip movement. This allows for a reduced initial investment when trading smaller lots.

Conclusion

In conclusion, a lot in forex trading represents the standardized unit of currency that is bought or sold in a trade. Understanding the concept of lots is essential for effectively managing risk, determining position sizes, and calculating profits and losses in forex trading. Whether it’s a standard, mini, micro, or nano lot, each represents a different quantity of currency units and carries its own implications for trading strategies and risk management.

By mastering the concept of lots and incorporating it into one’s trading approach, traders can enhance their ability to navigate the forex market with confidence and precision.