Harmonic Patterns Scanner

Definition of Harmonic Patterns

Harmonic patterns are a class of technical analysis patterns that traders use to forecast future price movements in financial markets. These patterns are formed by a series of retracements and extensions based on Fibonacci ratios. The key characteristic of harmonic patterns is the precise alignment of Fibonacci levels, creating geometric shapes within price charts. Traders believe that these patterns signal potential reversals or continuations in the price trend, providing opportunities for profitable trading.

Traders use harmonic patterns in conjunction with other technical analysis tools to confirm signals and make trading decisions. These patterns are considered more advanced and require a deep understanding of Fibonacci ratios and market dynamics for effective utilization.

Overview of different types of Harmonic Patterns

Harmonic patterns are a class of technical analysis patterns that traders use to forecast future price movements in financial markets. These patterns are formed by a series of retracements and extensions based on Fibonacci ratios. The key characteristic of harmonic patterns is the precise alignment of Fibonacci levels, creating geometric shapes within price charts. Traders believe that these patterns signal potential reversals or continuations in the price trend, providing opportunities for profitable trading.

There are several types of harmonic patterns, including:

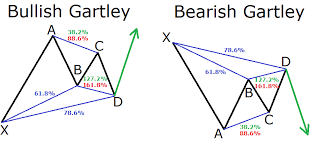

- Gartley Pattern: Named after H.M. Gartley, this pattern consists of retracements and extensions forming a distinctive M or W shape.

- Butterfly Pattern: This pattern resembles a butterfly and involves a series of Fibonacci ratios, typically indicating potential trend reversals.

- Bat Pattern: Similar to the butterfly pattern, the bat pattern is characterized by specific Fibonacci ratios and is considered a reversal pattern.

- Crab Pattern: The crab pattern is a more complex harmonic pattern, involving deeper retracements and extensions, often signaling significant trend reversals.

- Cypher Pattern: The cypher pattern is a relatively newer addition to harmonic patterns, identified by specific Fibonacci ratios and often indicating potential reversals.

Traders use harmonic patterns in conjunction with other technical analysis tools to confirm signals and make trading decisions. These patterns are considered more advanced and require a deep understanding of Fibonacci ratios and market dynamics for effective utilization.

Importance of identifying Harmonic Patterns in trading

Identifying Harmonic Patterns in trading holds significant importance for traders due to several key reasons:

- Predictive Power: Harmonic patterns are believed to have predictive capabilities in forecasting future price movements. Traders use these patterns to anticipate potential trend reversals or continuations, allowing them to enter or exit positions at favorable points.

- High Probability Setups: Harmonic patterns are based on precise Fibonacci ratios, which are derived from natural mathematical relationships found in financial markets. Traders consider these patterns as high probability setups due to the confluence of multiple Fibonacci levels, increasing the likelihood of price reactions at these points.

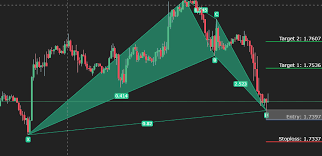

- Risk Management: By identifying Harmonic Patterns, traders can effectively manage risk by placing stop-loss orders and defining risk levels based on the structure of the pattern. This helps traders limit potential losses and protect their capital in case the market moves against their position.

- Enhanced Timing: Harmonic patterns provide traders with precise entry and exit points, enhancing timing in their trading strategies. Traders can capitalize on market inefficiencies and price anomalies identified by these patterns, leading to improved profitability.

- Confirmation Tool: Harmonic patterns serve as confirmation tools when used in conjunction with other technical analysis techniques such as trendlines, support and resistance levels, and momentum indicators. Confirmation from multiple sources increases traders’ confidence in their trading decisions.

- Scalability: Harmonic patterns can be applied across various timeframes and financial instruments, making them suitable for traders with different trading styles and preferences. Whether trading stocks, forex, commodities, or cryptocurrencies, traders can utilize Harmonic Patterns to identify trading opportunities.

- Technical Analysis Framework: Incorporating Harmonic Patterns into a comprehensive technical analysis framework provides traders with a structured approach to analyzing price charts. This systematic methodology helps traders identify patterns consistently and objectively, reducing the influence of emotions in trading decisions.

Overall, identifying Harmonic Patterns in trading can significantly enhance traders’ ability to analyze market dynamics, make informed trading decisions, and ultimately improve their trading performance.

Purpose of the Harmonic Scanner

The purpose of a Harmonic Pattern Scanner is to automate the detection and analysis of Harmonic Patterns in financial markets. This tool serves several key functions for traders:

- Efficiency: Manual identification of Harmonic Patterns can be time-consuming and prone to human error. A Harmonic Pattern Scanner automates this process, swiftly scanning through price charts across multiple timeframes and financial instruments to identify potential patterns.

- Accuracy: Human traders may overlook or misinterpret subtle Harmonic Patterns, leading to missed trading opportunities or erroneous analysis. A Harmonic Pattern Scanner utilizes algorithms to precisely identify patterns based on predefined criteria, improving accuracy and reducing the likelihood of false signals.

- Real-time Analysis: Financial markets operate in real-time, with prices fluctuating rapidly. A Harmonic Pattern Scanner continuously monitors price movements and provides real-time alerts when potential Harmonic Patterns emerge, allowing traders to capitalize on timely trading opportunities.

- Objective Analysis: Emotions and cognitive biases can influence human decision-making in trading. By relying on a Harmonic Pattern Scanner, traders can conduct objective analysis based on predefined criteria, minimizing the impact of subjective factors on trading decisions.

- Scalability: Traders may monitor multiple financial instruments simultaneously or trade across various timeframes. A Harmonic Pattern Scanner offers scalability, enabling traders to analyze a large number of charts efficiently and identify patterns across different markets and timeframes.

- Customization: Different traders may have unique preferences regarding pattern parameters, such as minimum and maximum retracement ratios or specific pattern variations. A Harmonic Pattern Scanner typically offers customization options, allowing traders to tailor the scanning criteria to their individual trading strategies and preferences.

- Backtesting and Analysis: Traders often rely on historical data to validate trading strategies and assess their performance. A Harmonic Pattern Scanner may offer backtesting and analysis features, enabling traders to assess the profitability and reliability of Harmonic Patterns over historical data.

In summary, the purpose of a Harmonic Pattern Scanner is to streamline the process of identifying and analyzing Harmonic Patterns in financial markets, providing traders with efficient, accurate, and objective insights to inform their trading decisions and strategies.